A Venture Capital Trust (VCT) is a publicly listed company. The company, run by a fund manager, invests in a number of small unquoted companies. Therefore an investor into a VCT is investing in the fund manager’s selected portfolio of earlier stage UK companies, and thereby helps them to grow. To encourage investment of this sort, the government provides a number of tax benefits to qualifying UK investors

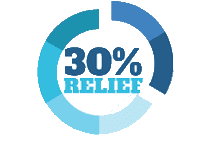

Actual net cash outlay 70 pence in the £1

No Capital Gains Tax to pay

Dividends from your VCT shares are not subject to income tax

We have a range of investment opportunities on the platform to help you build a diversified portfolio

Further information on VCTs can be found on the HMRC website, as well as on the AIC website, the trade organisation for the industry

GrowthInvest is a trading name of EIS Platforms Limited. EIS Platforms Limited (FRN: 694945) is an appointed representative of Sapphire Capital Partners LLP (FRN:565716) which is authorised and regulated by the Financial Conduct Authority in the UK.

All rights reserved 2024 @ growthinvest