Onboarding Assets

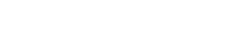

One of the most effective ways to maximise the value of the GrowthInvest platform is to transfer on all existing tax-efficient investments. This not only creates a strong foundation for future investment decisions—such as making use of our rolling VCT reinvestment solution—but also brings all investments, valuations, reports, and documentation into one easily accessible location. By consolidating what is often a historically fragmented landscape, we simplify portfolio oversight, streamline administration, and enhance clarity on a historically disparate market.

Our experienced onboarding team of analysts ensures that each portfolio is accurately reflected on the platform, complete with the latest valuations, full transactional history from life to date, and all relevant supporting documentation. This forms the basis for ongoing portfolio support, underpinned by our well-established reporting infrastructure across the wider market.

Best of all, we manage the entire process from start to finish.

Why Onboard?

Access

How To Onboard

Consolidate investments with ease. GrowthInvest lets clients streamline their historical and legacy tax-efficient investments in just five simple steps. Our expert team takes care of the details, working closely you to keep the process simple, clear, and efficient.

1. Provide Information

Gather details about your holdings such as an asset register, tax and share certificates and/or investment documentation.

2. Portfolio Analysis & Preparation

Following a review of the information, our team will draft and share Letters of Authority (LOAs) with you for digital signature. These allow GrowthInvest to access portfolio data and establish ongoing reporting lines with the providers.

3. Review and Onboard

Our team will carefully review the provided information and let you know if anything further is required. If not, the team will onboard the assets onto the GrowthInvest platform.

4. Login

Once the process is complete, our team will confirm via email that the portfolio is live on platform. You’ll now be able to access valuation and transactional level data, alongside bespoke reporting and fund manager documents.

5. VCT Dematerialisation

If an onboard includes VCTs there is a final step in the process. Upon completion of the initial onboard of assets, the team will send you a CREST transfer pack, they should print and wet sign the documents and return them with original share certificates. We will then dematerialise the shares into digital form, enabling dividends to be paid directly to your GrowthInvest account. This also allows you to participate in VCT buy-backs once shares reach the required 5 year holdings period. For further information, can be obtained from our buy-back calendar or other educational materials.

6. Optional: Sale on Secondary Market

Once the VCT assets have been dematerialised, your client may choose to sell any of their VCT investments that exceed the required 5 year holding period. For more information please review our VCT Rolling Investments guide or reach out to our team.