The much-hyped UK Autumn Budget delivered on 26 November 2025 by chancellor Rachel Reeves gave a fair amount of prominence to the pillars of the early stage and scale up funding in the UK, Venture Capital Trusts (VCTs) and Enterprise Investment Scheme (EIS), with the expected and requested increases to annual and lifetime investment limits very much front and centre. Industry reaction, however, has been tempered, with the entirely unexpected announcement of a change in initial income tax relief on VCTs from 30% where it has been for 20 years, down to 20%. Further generous increases on the UK’s existing employee equity tax advantaged schemes – EMI (Enterprise Management Incentives) -are also clearly aimed at supporting fast growing UK scale-up companies who were hitting the previous eligibility limits just when they needed them most.

The Chancellor is clearly very much backing the Venture capital schemes overall and banking a fair amount of political capital in statements such as “make Britain the best place in the world to start up and scale up and to stay”. There has been a long-term theme that it is very hard to secure scale up funding in the UK, and this budget looks to have tried very hard to address this. Whether, as the AIC, say this may all be “in vain” will only really become clear over the next tax year 2026-27.

Below is a summary of the changes, some market reactions and a start to look at what these changes mean for advisers, investors, and the wider market.

Key Legislative Changes

- VCT income tax relief reduced from 30% to 20% for subscriptions made on or after 6 April 2026.

- VCT tax free dividends remain in place

- VCT CGT-free capital growth

- EIS income tax relief remains at 30%

- Investment limits increased: annual company limit have been doubled to £10m (previously £5m), the lifetime limit is increased to £24m; Knowledge Intensive Companies (KICs) have seen that pushed up £20m annual and £40m lifetime.

- Gross asset test raised to £30m pre-issue and £35m post-issue.

Enterprise Management Incentive Schemes:

- Employee limit doubled to having up to 500 employees participating (up from 250)

- Gross assets test raised to £120 million up from £30 million

- Individual holding raised to £6million (up from £3M)

- Ability for EMI holders to exercise their options at a PISCES (Private Intermittent Securities and capital Exchange System) event, potentially allowing employees some liquidity before a full company sale.

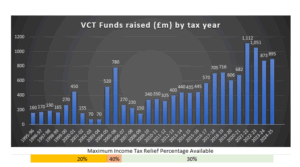

VCT & EIS Raise Amounts – Some Historical Context

VCTs were launched in 1995 with 20% relief, later increased to 40% in 2004, sparking record fundraising at the time, up to £750M, a figure only beaten with the current all-time high of 1.2BN in 2021/22. It is worth noting that the last time income tax relief was at 20% was back in 2004 when the total raise amount was only £70M! Whilst there are many other factors that mean this is not a direct comparable, it is worth noting that the reduction from 40% down to 30% in 2006 caused a 65% drop in subscriptions, with recovery taking well over a decade before the recent record years from 2020 onwards.

VCTs were launched in 1995 with 20% relief, later increased to 40% in 2004, sparking record fundraising at the time, up to £750M, a figure only beaten with the current all-time high of 1.2BN in 2021/22. It is worth noting that the last time income tax relief was at 20% was back in 2004 when the total raise amount was only £70M! Whilst there are many other factors that mean this is not a direct comparable, it is worth noting that the reduction from 40% down to 30% in 2006 caused a 65% drop in subscriptions, with recovery taking well over a decade before the recent record years from 2020 onwards.

EIS on the other hand, introduced in 1993, had an overall consistent upward trend, peaking at £2.3bn in 2021/22 before dropping down to £1.6bn in recent years. We would think that this slight downward trend will be reversed next year, and we could be looking at record years for EIS investment.

Summary

- VCTs and EIS will now be able to better support companies through their continued growth with significant extensions of the lifetime investment limits

- VCTs remain attractive for tax-free dividends and CGT exemption, but upfront incentives are now weaker.

- EIS is likely to gain in popularity due to unchanged 30% relief and extended availability.

At GrowthInvest, we believe these changes underscore the importance of diversification and proactive planning. VCTs and EIS will continue to play increasingly important roles in clients’ tax-efficient and alternative investment strategies and continue to offer compelling opportunities for those seeking relief and longer-term exposure to innovative UK businesses. Our platform remains committed to providing access, insight, and support for advisers navigating this evolving landscape.